Heartwarming Tips About How To Claim Ira Contributions

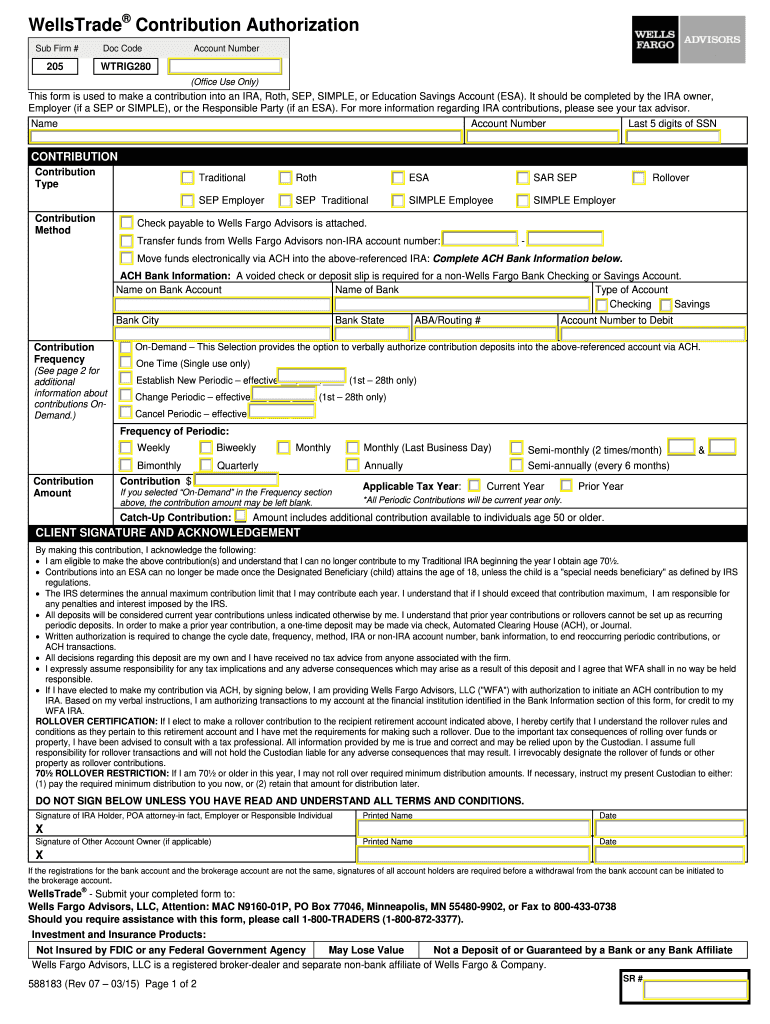

You can make a contribution to your ira by having your income tax refund (or a portion of your refund), if any, paid directly to your traditional ira, roth ira, or sep ira.

How to claim ira contributions. When tracy ponte's father passed in 2015, she inherited the funds in his ira account. They also work like traditional iras: Washington — the internal revenue service notes that taxpayers of all ages may be able to claim a deduction on their 2020 tax return for contributions to their.

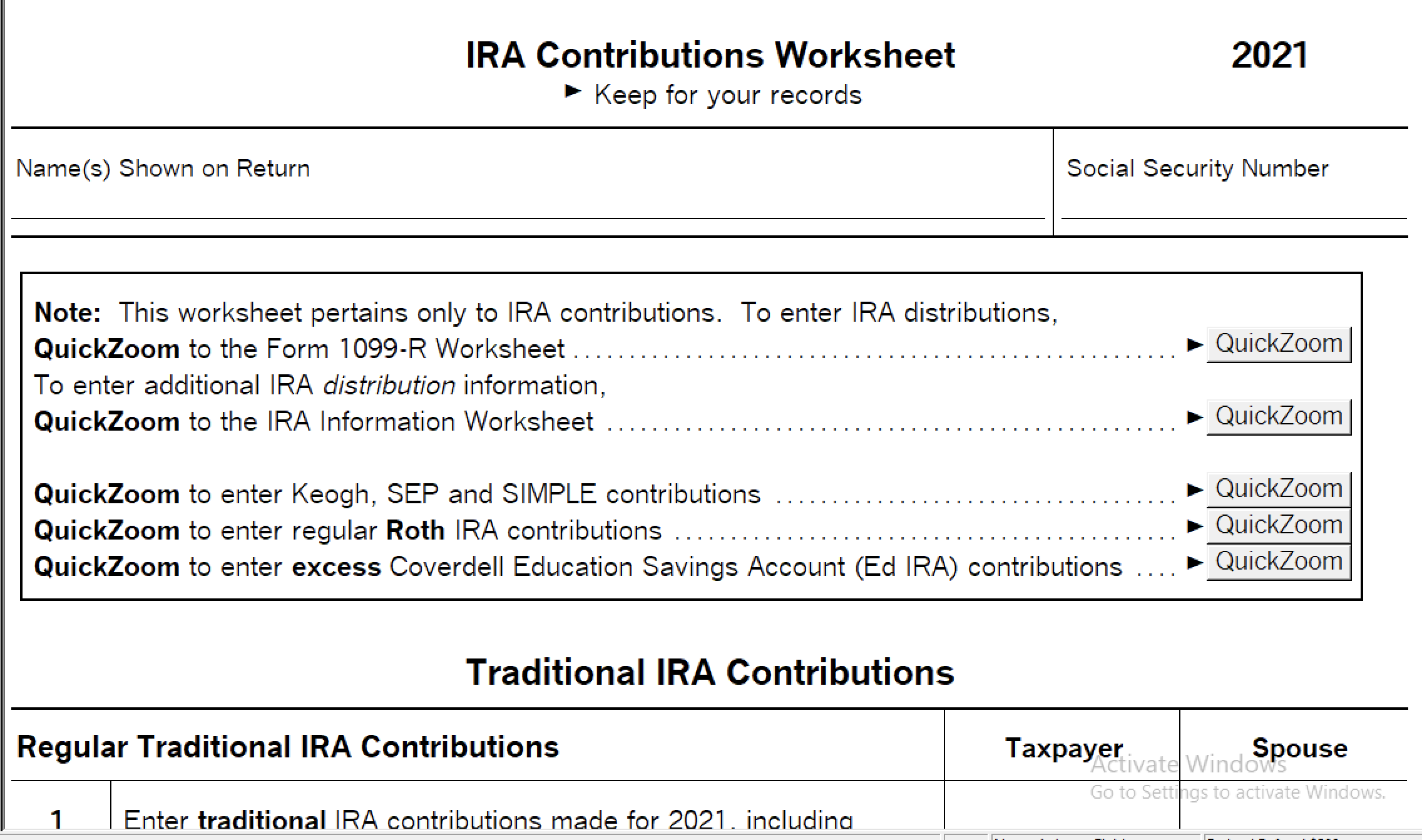

You're allowed to make an additional catchup contribution of $1,000 for an annual total of $7,000 if. Form 5498 when you save for retirement with an individual retirement arrangement (ira), you probably receive a form 5498 each year. In the search bar, type ira.

For 2022, single investors using a workplace retirement plan may claim a tax break for their entire ira contribution if their modified adjusted gross income is $68,000. Open or continue to your return. To enter your 2023 ira contributions (money you put into your ira):

Ira contribution information is reported for each person for whom any ira was maintained, including sep or simple iras. Ira contributions will be reported on form 5498: Fidelity smart money key takeaways the ira contribution limits for 2023 are $6,500 for those under age 50 and $7,500 for those 50 and older.

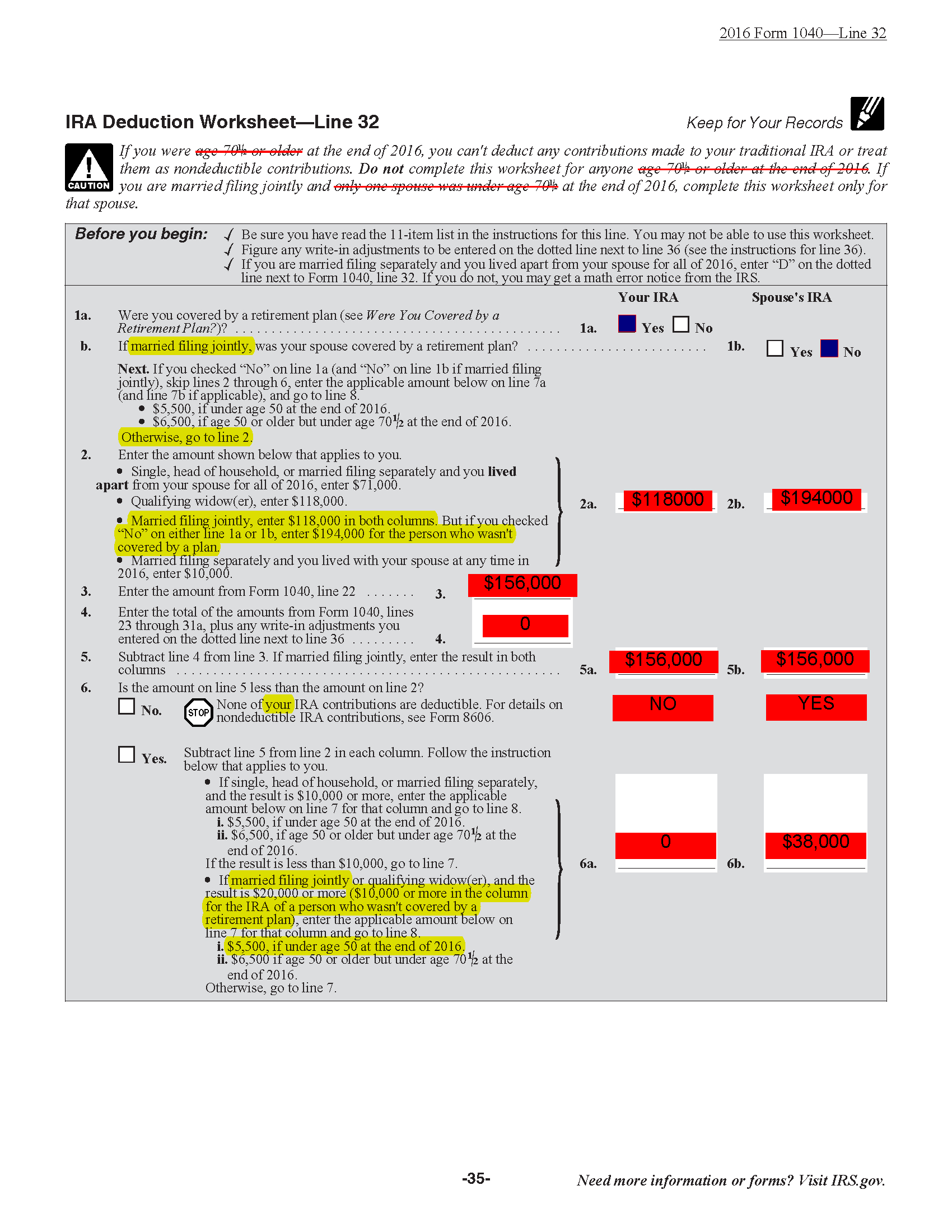

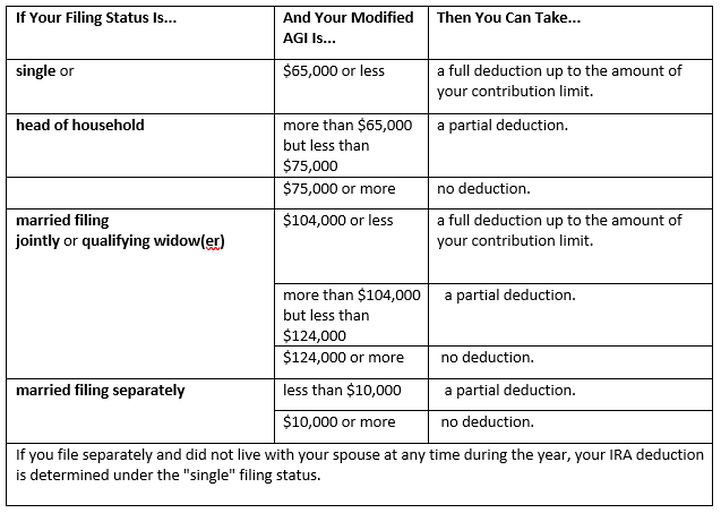

Eight years later, in 2023, tracy filed for chapter 7 bankruptcy. Advertisement when can you no longer contribute to a roth ira? Deductions vary according to your modified adjusted gross income (magi) and whether or not you're covered by a retirement plan at work.

You can contribute $6,000 to your ira in the 2022 tax year. The amount you can deduct from your taxable income depends on your modified adjusted gross income, if you or your spouse is covered by a workplace. That $6,500 or $7,500 in 2023 is the total you can deduct for all contributions to qualified retirement plans.

If you (and your spouse,. Having a 401(k) account at work doesn't affect your eligibility to make ira contributions, and you can deduct up to the maximum annual contribution of $22,500 in 2023 and. For 2024, this is $7,000 or $8,000.

Contributions you make to a traditional ira may be fully or partially deductible, depending on your filing status and income, and generally, amounts in your. Get information about ira contributions and claiming a deduction on your individual federal income tax return for the amount you contributed to your ira. So if you decide to contribute to a traditional ira, be sure to claim your contributions when you file your taxes with a service like turbotax or h&r block.

![Roth IRA Contribution Cheat Sheet [INFOGRAPHIC] Inside Your IRA](https://i.pinimg.com/736x/64/c2/1e/64c21e42511813459272d9a12af6b674.jpg)

:max_bytes(150000):strip_icc()/why-is-this-so-complicated--494146703-5bde4865c9e77c005158206f.jpg)